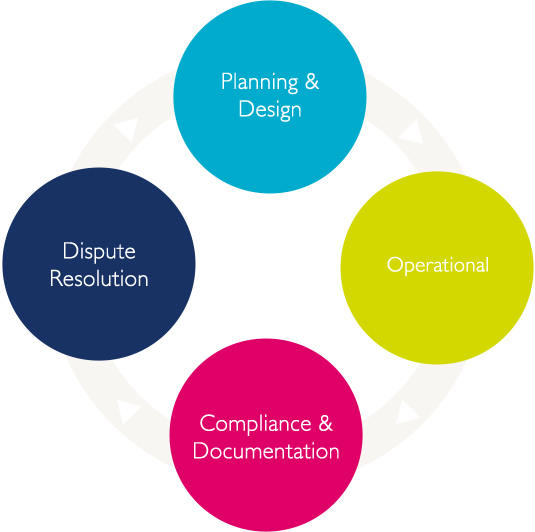

Our services cover all aspects of the advisory and compliance TP business lifecycle:

Planning & Design

Whether long-standing international structures exist or the group is new to international business, there can be TP design needs. We have extensive practical experience in design and implementation of TP policies and operating models, arising from material factual, market or economic change. All transaction types including intellectual property, tangible goods, services and financing are in scope.

Regulatory changes can alter the landscape, giving rise to changing operating models. OECD activity around the BEPS initiative could, for example, mean that there is a desire to move away from stripped risk distribution or commissionaire structures and replace them with more traditional full risk buy/sell distribution models.

Groups need to be confident that their structures are robust and generate results which satisfy the arm’s length principle, whether under OECD, US §482 or UN guidance.

Operational

Changes in operating models require practical, hands on, operational support. In our experience, a lack of operational TP support can let down the very best theoretical model. Real-time implementation and ongoing running of TP design adds incremental value.

We have the technical IT expertise to assist with model implementation, from data retrieval to the modelling of business transactions, enabling price setting, monitoring and adjustment, as necessary to satisfy the arm’s length standard.

Compliance & Documentation

Country specific requirements have increased exponentially over recent years. In practice, the more traditional TP documentation needs are wider than may be expected. The scope of TP documentation and compliance that we can assist with includes:

- TP risk reviews by entity, country, business unit or covering global operations

- TP training, pitched at whatever level you choose

- TP policy writing

- Formal legal agreements

- Thin capitalisation reviews

- TP Master files

- Local files (Country specific), including comparable data where required

- FIN 48

High profile TP Country by Country reporting requirements will also impact the largest MNC groups.

Our approach to documentation is bespoke to individual needs, rather than “one size fits all”.

Dispute Resolution

We have practical experience of dealing with authorities across Europe, Asia and the Americas and would be pleased to assist with the following requirements:

- Detailed documentation support under scrutiny

- Assistance with meetings and correspondence with taxing and other authorities

- Managing TP communications with tax authorities or non specialist TP advisors

- MAP procedures under the DTT or Arbitration Convention to seek tax symmetry

- Global or Country specific TP risk analysis

- APAs

- Thin cap disputes and clearances